Published: September 2025

Last Updated: September 2025

Key Takeaways

✅ A written contractor agreement is crucial for every UK small business.

✅ Clearly define scope of work, payment, IP, confidentiality, and termination.

✅ Protect your business by verifying contractor status and insurance.

✅ Misclassification risks under IR35 can be costly.

✅ Always include a clear intellectual property clause.

✅ Tailor every agreement to your specific project and business needs.

✅ Seek professional advice for high value or complex contracts.

✅ Keep up to date with changes to UK law affecting contractors.

Independent Contractor Agreements – Quick Definition

Independent Contractor Agreements: A legally binding written agreement between a business and an individual or company, setting out the terms under which work is completed by the contractor rather than an employee. Also called a freelance contract or consultancy agreement.

Purpose: To define the work relationship, payment terms, and responsibilities while protecting both parties and clarifying status under UK law.

Introduction & Context

Every small business in the UK is likely to hire an independent contractor at some point. Whether you are a startup founder needing a website, an accountant, or a builder needing specialist trades, you’ll use a contractor agreements to ensure everyone is on the same page.

With UK law becoming stricter about the distinction between employees and independent contractors, it’s vital to get your paperwork right. The wrong agreement can expose your business to tax penalties, PAYE liabilities, or legal disputes. In 2021, Uber lost a landmark UK Supreme Court case, which found many of their drivers were workers, not contractors, leading to backdated holiday pay and minimum wage.

This complete guide explains what to include in every contractor agreements sunder English law, the risks, and how to protect your business. We will look at real-world examples, practical tips, essential clauses, and how to avoid the most common pitfalls for UK small businesses.

Hiring Independent Contractors in UK

When you hire contractors in the UK, it’s important to understand that they are self-employed individuals or businesses, unlike employees who work directly under your control. This distinction affects everything from tax treatment to employment rights.

Independent contractors usually set their own hours and use their own tools. They are responsible for their own taxes and do not receive employee benefits such as holiday pay or sick pay. Because of this, the terms and conditions you include in your contractor agreements should clearly outline the nature of the relationship to avoid confusion.

Since contractors often work with multiple clients, the agreement must specify the agreed-upon scope of work, deliverables, and payment terms. This clarity helps avoid potential disputes about responsibilities or expectations.

By properly classifying and managing your relationship with contractors, you protect your business from legal risks and ensure a smooth working relationship that benefits both parties.

Contractor Agreement – Key Components

A well-drafted contractor agreement is the backbone of a safe and productive contractor relationship. Under English law, a written agreement is not always mandatory, but it is always strongly recommended.

Essential Elements That Must Be Included

Party Identification

Clearly state the legal names and addresses of both the contractor and the business. This identifies who is bound by the agreement.

Scope of Work and Deliverables

Define exactly what work the contractor will provide. This section should list specific tasks, expected outcomes, and deadlines. Vague descriptions create confusion and disputes.

Payment Terms

Set out how, when, and how much the contractor will be paid. Include the rate (hourly, daily, fixed fee), invoicing process, and payment schedule.

Timeline and Duration

The agreement should specify the start date, estimated duration, and the process for end the agreement or extend it.

Termination Clause

This key clause should allow either party to terminate the agreement, stating the notice period and what happens on termination (such as final payments and return of confidential information).

Confidentiality and Data Protection

Confidentiality clauses are vital for protecting your business secrets and data. Ensure the agreement covers GDPR obligations for handling personal data.

Intellectual Property Rights

You must clarify that all intellectual property created by the contractor is owned by your business, unless otherwise agreed.

Dispute Resolution

This section of the agreement should set out what happens if there is a dispute, including negotiation, mediation, or English court jurisdiction.

Compliance with Law

State that the agreement is governed by English law and complies with regulations such as IR35 (off-payroll working rules), which affects many contractor relationships in the UK.

| Component | Why It Matters |

|---|---|

| Party Identification | Defines who is bound by the agreement |

| Scope of Work | Prevents misunderstandings and scope creep |

| Payment Terms | Ensures timely and fair payment |

| Timeline/Duration | Clarifies expectations |

| Termination Clause | Allows exit on fair terms |

| Confidentiality | Protects business secrets |

| Intellectual Property | Ownership of work products |

| Dispute Resolution | Reduces legal risk and costs |

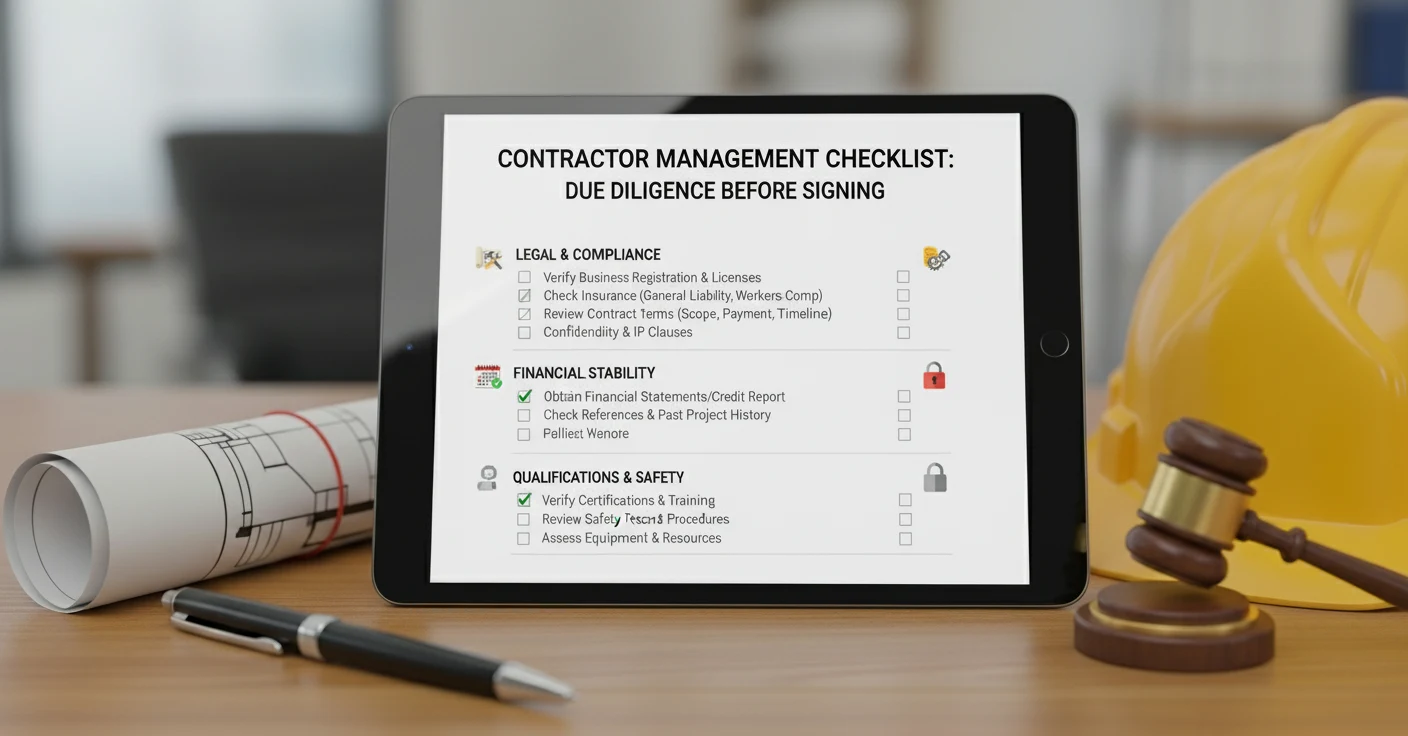

Due Diligence – Verifying the Agreement Before You Sign

Before you sign an independent contractor agreement, both parties should carry out due diligence to avoid problems later. This process minimises legal and financial risks.

Check Contractor Status

Make sure the individual is genuinely a contractor and not an employee under UK law. Key factors include whether the contractor is responsible for their own tax, can substitute another person, and controls how and when the work is done. HMRC provides clear guidelines on determining employment status.

Review the Contractor’s Background

Check references, qualifications, insurance, and previous work. This step is essential for roles involving regulated activities or access to sensitive information.

Verify Business Structure and Insurance

Ask for proof that the contractor is registered as a sole trader or limited company and has appropriate insurance (such as public liability and professional indemnity).

Confirm Ownership of Intellectual Property

If the contractor will create designs, code, or written content, confirm in writing that your business will own the intellectual property.

Clarify Confidentiality Requirements

Review how the contractor will protect your confidential information and data, especially under GDPR.

Tip: Use a checklist before signing. It can help you compare different contractors and ensure all legal requirements are covered.

Common Scenarios & Use Cases

Hiring IT Consultants

UK businesses often use specialist IT contractors to upgrade systems or develop software. For example, the NHS often hires IT consultants for short-term projects, using detailed agreements to define scope and IP ownership.

Construction and Trades

Building companies regularly engage independent electricians, plumbers, or architects. Their agreements specify not only the work but also insurance, safety compliance, and payment terms.

Creative and Design Services

Design agencies use independent contractor agreement templates with freelance graphic designers to clarify that all artwork becomes the property of the agency on payment.

Professional Services

Law firms and accountants sometimes bring in experts on a contract basis, using contractor agreements to avoid employment status and to define responsibilities.

Marketing and Content

Social media managers and content writers often work as freelancers for UK SMEs. Their contracts cover confidentiality, payment, deadlines, and IP rights.

Tax Implications

Understanding tax is vital when managing independent contractor agreements in the UK.

Contractor’s Tax Duties

Contractors are responsible for their own income tax and National Insurance contributions. If they work through a limited company, corporation tax may also apply.

IR35 and Off-Payroll Working

IR35 rules ensure contractors who work like employees pay similar tax to employees. Since April 2021, many private sector businesses must assess whether IR35 applies. If it does, you may need to deduct tax and National Insurance at source.

VAT and Invoicing

If the contractor is VAT registered, check that VAT is charged correctly on invoices.

Penalties for Misclassification

If HMRC decides a contractor is really an employee, your business could owe unpaid tax, interest, and penalties. The 2021 Uber ruling made this risk clear for all UK employers.

| Tax Issue | Contractor | Employee |

|---|---|---|

| Income Tax | Contractor pays | Employer deducts |

| National Insurance | Contractor pays | Employer deducts |

| VAT | May be VAT registered | Not applicable |

| IR35 | May apply | Not applicable |

Critical Risk Areas & Pain Points

Misclassification and IR35

Misclassifying employees as contractors is one of the biggest risks. In the Pimlico Plumbers case, the Supreme Court found a plumber was a worker, not a contractor, leading to holiday pay and pension liabilities for Pimlico.

Intellectual Property Disputes

If your agreement does not clarify IP ownership, the contractor may keep rights to work they have created. This is common in software development and design.

Confidentiality Breaches

A weak confidentiality clause can result in leaked trade secrets or client data, potentially breaching GDPR.

Scope Creep and Payment Delays

Unclear scope of work leads to extra tasks, arguments, and late payments. This is a frequent cause of disputes between UK SMEs and contractors.

Termination Issues

Without a clear termination clause, it may be hard to end a contract or recover work already paid for.

Practical Solutions & Best Practices

Negotiate Key Clauses Upfront

Discuss all terms before work starts. Use a contractor agreement template tailored to UK law as a starting point, but always adapt it for your specific project.

Must-Have Protective Clauses

- Intellectual Property: State that all IP created by the contractor will belong to your business.

- Confidentiality: Include a strong confidentiality clause covering data protection and GDPR compliance.

- Termination: Specify how and when either party can end the agreement, the notice period, and the consequences.

- Indemnity: The contractor agrees to indemnify your business for any loss caused by their actions.

- Non-Compete: If needed, restrict the contractor from working for direct competitors during and after the contract, within reason.

Red Flags to Avoid

- Contractors who refuse to provide insurance or references

- Vague scope of work or payment details

- Absence of clear IP and confidentiality terms

When to Seek Professional Help If your contract involves high-value work, complex IP, or falls under IR35, get advice from a solicitor experienced in business and employment law.

Tip: A well-drafted contractor agreement is a legal safety net. Spending time upfront saves disputes and costs later.

FAQ Section

Q: Do I need a written contractor agreement for every project?

A: While not always required by law, a written agreement is crucial for clarity and protection. It helps prove contractor status if challenged by HMRC.

Q: Can I use a free template from the internet?

A: Templates are a good start, but always tailor them for your business and check they comply with UK law.

Q: Who owns the work created by the contractor?

A: Unless your agreement states otherwise, the contractor may keep ownership. Always include an intellectual property clause.

Q: How can I end the agreement if things go wrong?

A: Check the termination clause for notice periods and grounds for termination. If in doubt, seek legal advice.

Q: What is IR35 and does it affect my business?

A: IR35 is UK tax legislation targeting ‘disguised employment’ via contractors. If your contractor works like an employee, IR35 may apply.

Q: What happens if there is a dispute?

A: The dispute resolution section should set out the process, often starting with negotiation or mediation before court action.

Glossary of Terms

IR35: UK tax legislation to identify ‘disguised employees’ working as contractors

Scope of Work: Detailed description of services the contractor will provide

Deliverables: The actual outputs or products the contractor is required to produce

Confidentiality Clause: Part of the agreement protecting business secrets and data

Termination Clause: Sets out how and when the contract can be ended

Indemnity: Protection against losses caused by one party’s actions

Intellectual Property Rights: Ownership of creations such as software, designs, or inventions

GDPR: General Data Protection Regulation, UK and EU data protection law

Non-Compete Agreements: Restrict contractors from working for competitors

PAYE: Pay As You Earn, UK system for employee income tax and National Insurance

Contractor Management: Ongoing process of overseeing contractor relationships

Employment Contract: A contract for employees, distinct from contractor agreements

Written Agreement: Documented contract signed by both parties

HMRC: Her Majesty’s Revenue and Customs, the UK tax authority

Worker Status: UK legal status between employee and contractor, with some employment rights

Author Bio

Jay Gill is a Barrister at Law called to the Middle Temple and a senior business and legal strategist with over three decades of experience across Malaysia, Hong Kong, Australia and the UK. He served as Group Executive Director and internal Legal Counsel at a listed company in Hong Kong currently valued at USD8 billion. He also had 8 years of investment banking experience working on IPOs and M&As. Since 1995 he has run a freelance legal and business consultancy focused on commercial and corporate contracts, due diligence, feasibility studies and other corporate documents.

Disclaimer

This guide provides general information about independent contractor agreements for educational purposes. Every situation is unique and requires specific legal advice. Consult qualified legal counsel before classifying workers or entering contractor agreements. State and federal laws change frequently, and this guide cannot substitute for professional advice specific to your situation.

Tags: #ContractorAgreement, #IndependentContractor, #UKBusinessLaw, #IR35, #GDPR, #ContractDrafting, #IntellectualProperty, #Confidentiality, #SmallBusinessUK, #ContractorManagement, #LegalGuideUK